do you have to pay inheritance tax in kansas

Up to 15 cash back In Kansas do you have to pay inheritance tax on money received through a person that does not have a will but goes through probate. Currently there is a federal estate tax but it only applies to estates worth in excess of 543 million.

Ks Dor K 40 2020 2022 Fill Out Tax Template Online Us Legal Forms

The state sales tax rate is 65.

. Residents of Kansas and Missouri will be happy to hear that your states are not included in the six. In Pennsylvania for instance the inheritance tax applies to anyone inheriting property from a Pennsylvania resident even if the inheritor lives. This might not help you avoid inheritance taxes but it will lessen your estate taxes.

These two states are maryland and new. The annual exemption limit for 2022 is 16000 This means that there is no tax on gifts that do not exceed this amount. As of 2021 the six states that charge an inheritance tax are.

June 22nd 2018 - If you are a resident of the State of Illinois do you have to pay inheritance taxes in Illinois The answer is maybeprofessional small. Kansas Inheritance Tax Kansas eliminated its state inheritance tax in 1998 and has not reinstated an. If you received property from someone who died after July 1.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. Inheritance tax is strictly a state-mandated process there is no taxation from the federal government on individual inherited items. Kansas residents who inherit assets from Kansas estates do not pay an inheritance tax on those inheritances.

Surviving spouses are always exempt. That is a recent tax law change 2010. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

While Texas doesnt have an estate tax the federal. Kansas residents who inherit assets from kansas estates do not pay an inheritance tax on those inheritances. State inheritance tax rates range from 1 up to 16.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Kansas inheritance and gift tax. The estate tax is not to be confused with the inheritance tax which is a different tax.

This is a tax on the value of the estate to be paid by the estate. Taxes in Kansas to New Mexico Retirement Living June 24th 2018 - Explore income tax information for states from Kansas to New. Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570.

Talking about less than the big figure of l00000 where you always read federal tax is non-existent for the big amount of inheritance. The federal estate tax is calculated and paid before the estate is distributed to the decedents heirs. Kansas requires you to pay taxes if youre a resident or nonresident who receives income from a Kansas source.

Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9. In this detailed guide of the inheritance laws in the Sunflower. If you live in kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it.

These states have an inheritance tax. Kansas has no inheritance tax either. We have already discussed the.

The state income tax rates range from 0 to. You can give as much as 16000 to one person. Who has to pay.

Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. The tax due should be paid when the return is filed. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax.

There is no federal inheritance tax but there is a federal estate tax. Another states inheritance laws may apply however if you inherit money or assets from someone who lived in another state. The estate tax is not to be confused with the inheritance tax which is a different tax.

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Kansas Inheritance and Gift Tax. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it. Inheritance tax rates differ by the state. This gift-tax limit does not refer to the total amount you can give within a year.

Kansas eliminated its state inheritance tax in 1998 and has not reinstated an inheritance tax as of March 2013. Kansas Inheritance Tax Kansas eliminated its state inheritance tax in 1998 and has not reinstated an. However if the beneficiarys net inheritance tax liability exceeds 5000 and the return is filed timely an election can be made to pay the tax in 10 equal annual installments.

States including kansas do not have estate or inheritance taxes in place as of 2013. Currently there are only six states in the United States that assess the tax. States including kansas do not have estate or inheritance taxes in place as of 2013.

The state sales tax rate is 65. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. If the inheritance tax is paid within nine months of date of decedents death a 5 percent discount is allowed.

Massachusetts and oregon have the lowest. State laws are constantly changing but here is a list of the currently listed states that are collecting estate tax or inheritance tax at a local level. Does kansas have an inheritance tax.

Inheritances that fall below these exemption amounts arent subject to the tax. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. You would owe Kentucky a tax on your inheritance because Kentucky is.

Kansas Inheritance Laws What You Should Know

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Kansas And Missouri Estate Planning Minor Children

Estate Tax Planning Graber Johnson Law Group Llc

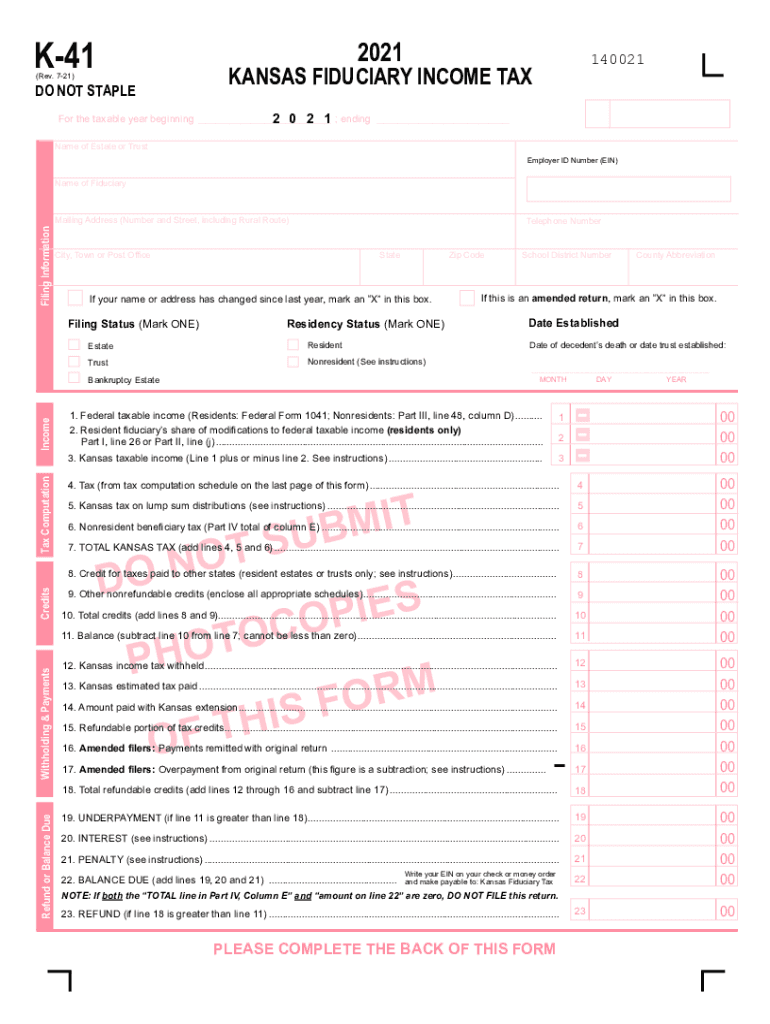

Ks Dor K 41 2021 2022 Fill And Sign Printable Template Online Us Legal Forms

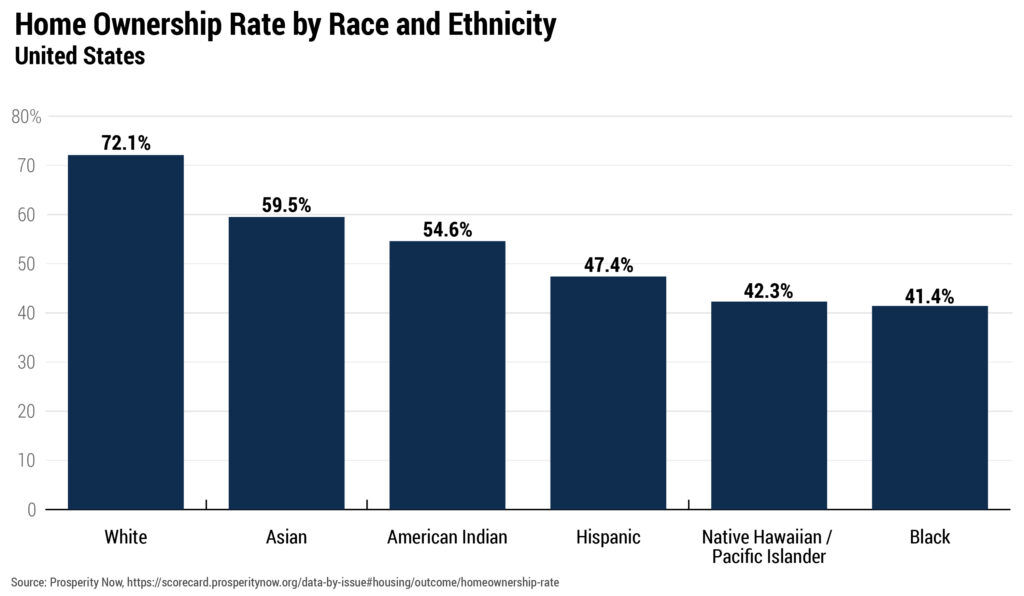

Taxes And Racial Equity An Overview Of State And Local Policy Impacts Itep

Tax Burden By State 2022 State And Local Taxes Tax Foundation

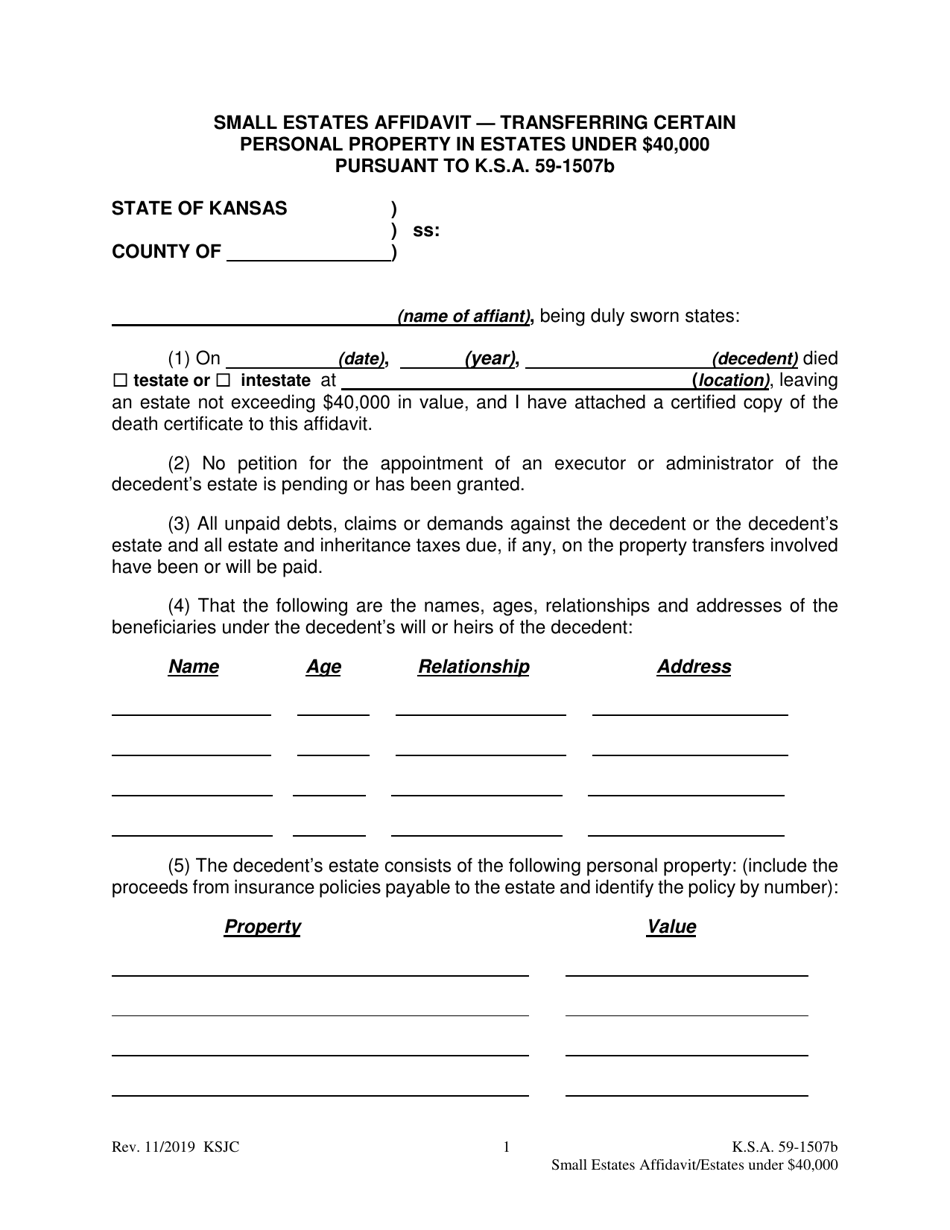

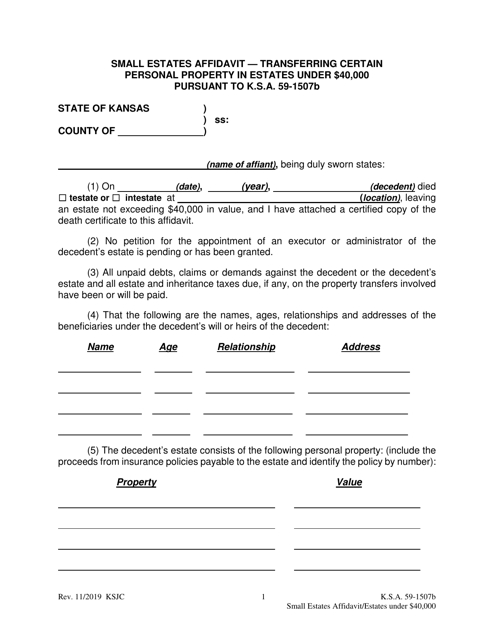

Kansas Small Estates Affidavit Transferring Certain Personal Property In Estates Under 40 000 Download Fillable Pdf Templateroller

The Comprehensive Guide To Estate Planning Carson Wealth

Kansas Inheritance Laws What You Should Know

Kansas Inheritance Laws What You Should Know

Everything You Need To Know About Missouri Tax Sale Process Kansas City Real Estate Lawyer

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Kansas Inheritance Laws What You Should Know

Kansas Small Estates Affidavit Transferring Certain Personal Property In Estates Under 40 000 Download Fillable Pdf Templateroller