what is suta taxable wages

How they affect you. Your states wage base.

Payroll Accounting Final Exam Flashcards Quizlet

Use the Unemployment Tax and Wage System TWS to.

. Benefit wage charges BWC are the taxable base period wages reported by an employer to OESC through the quarterly wage reports which are not to exceed the annual limit. The withholding rate is based on the employees Form W-4 or DE 4. If the employer paid 9000 in taxable wages in the first quarter of the year and their effective tax rate was 100 the amount of tax due is 100 of 9000 or 90.

Review the PIT withholding schedule. This will depend on the amount of wages that you pay during a calendar quarter. The current taxable wage base that Arkansas employers are required by law to.

The states SUTA wage base is 7000 per employee. Only the first 7000 of wages paid to each employee by their employer in a calendar year is taxable Applying and registering. There is no taxable wage limit.

The taxable wage base may change from year. In Florida in particular the taxable wage base is among the lowest in the country. File a Report of Change.

You have employees with the. File a Quarterly Wage Report. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

View Benefit Charge and Rate Notices. Additional Assessment for 2022 from 1400 to 000. It serves the same purpose as the SUTAcollecting taxes from employers for the purposes of providing unemployment benefits.

That means you dont pay the tax on any. There is no maximum tax. The State Disability Insurance SDI tax is calculated up to the SDI taxable wage limit of each employees wages and is withheld from the employees wages.

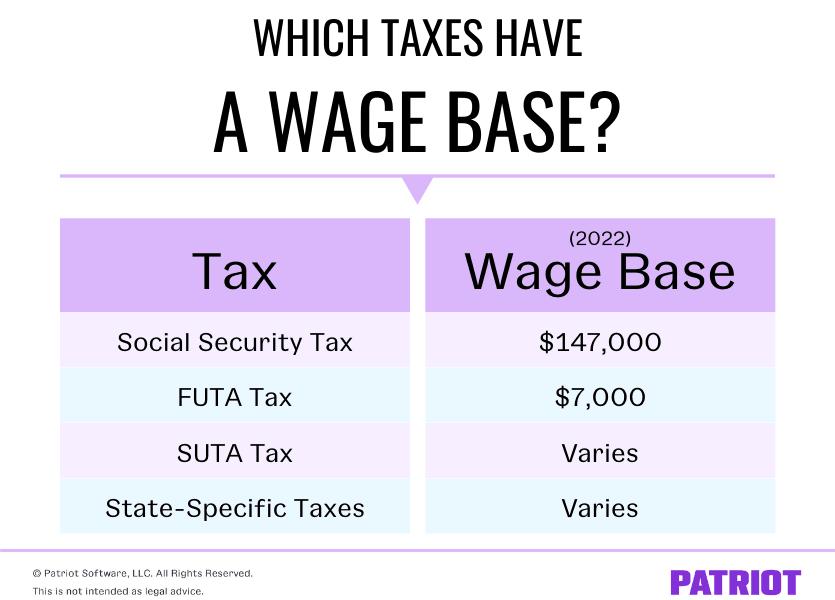

Base Tax Rate for 2022 from 050 to 010. The unemployment insurance tax is computed on the wages paid to each employee on a calendar quarter basis. The Taxable Wage Base is the amount of an employees wages upon which the employer is required to pay unemployment taxes each year.

You will be liable for state unemployment taxes if the total amount of wages you pay for domestic services in a. Special Assessment Federal Loan Interest Assessment for 2022 from 180 to 000. Using the formula below you would be required to pay 1458 into your states unemployment fund.

The wage base is the maximum amount of an employees gross income that can be used to calculate SUTA tax. For more information on this new law refer to Unemployment tax changes. Calculated amounts determine the contribution amounts to be paid or withheld for reporting to us.

The Taxable wage base for 2022 is 38000. Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27. Since your business has no history of laying off employees your SUTA tax rate is 3.

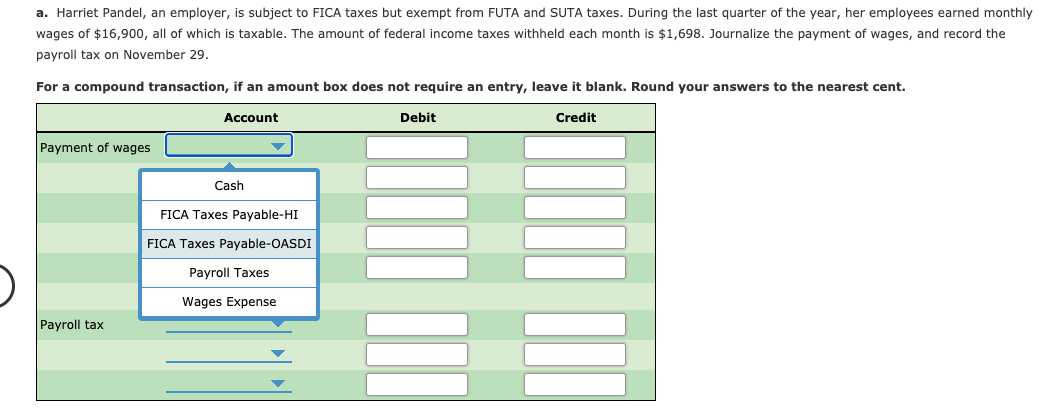

Answered Harriet Pandel An Employer Is Subject Bartleby

Exercise 11 5 Docx Exercise 11 5 Computing Suta Tax Lo 11 6 11 5 On April 30 2019 Chung Furniture Company Prepared Its State Unemployment Tax Course Hero

What Is Suta Understanding Unemployment Tax Basics

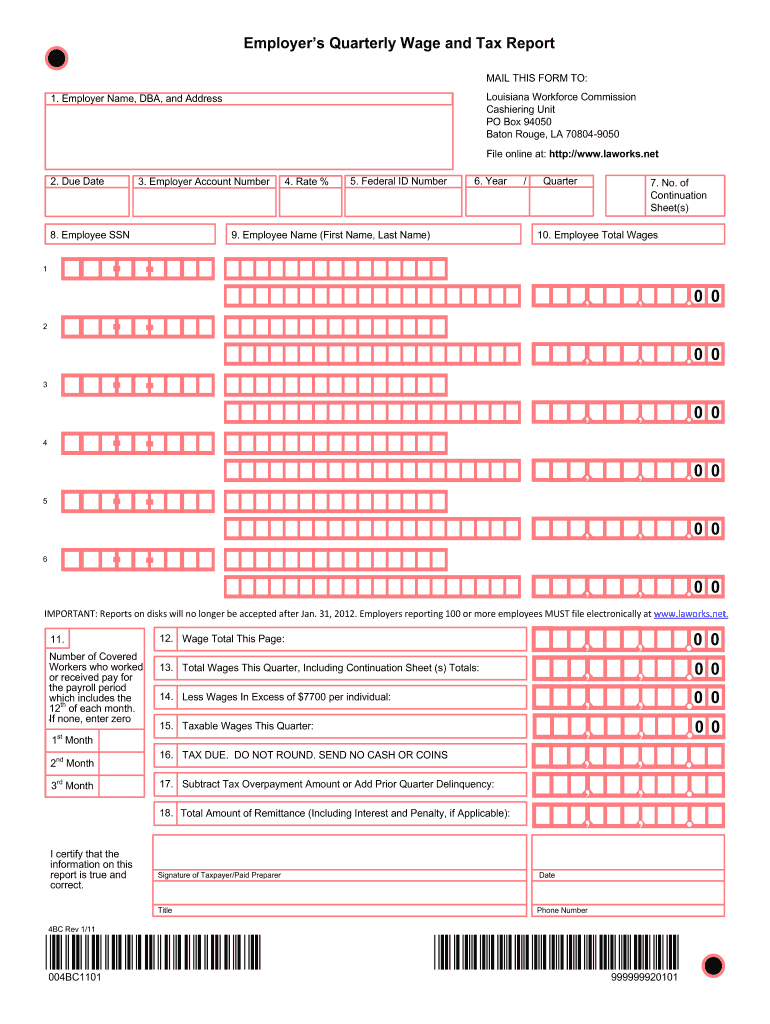

Lawage Reporting Fill Out Sign Online Dochub

Utah Unemployment Insurance And New Hire Reporting

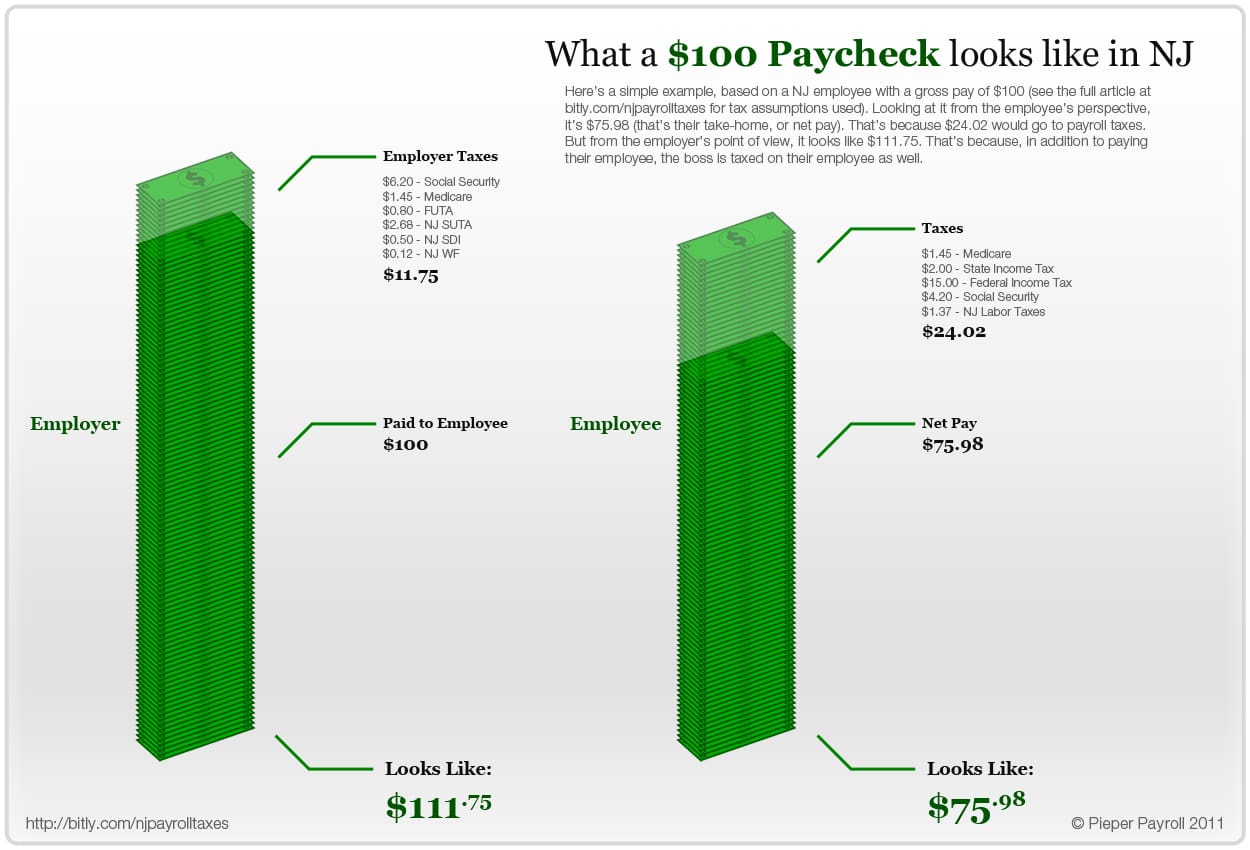

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

How To Fill Out Form 940 For Federal Unemployment Taxes

2018 Unemployment Cost Facts For Washington First Nonprofit Companies

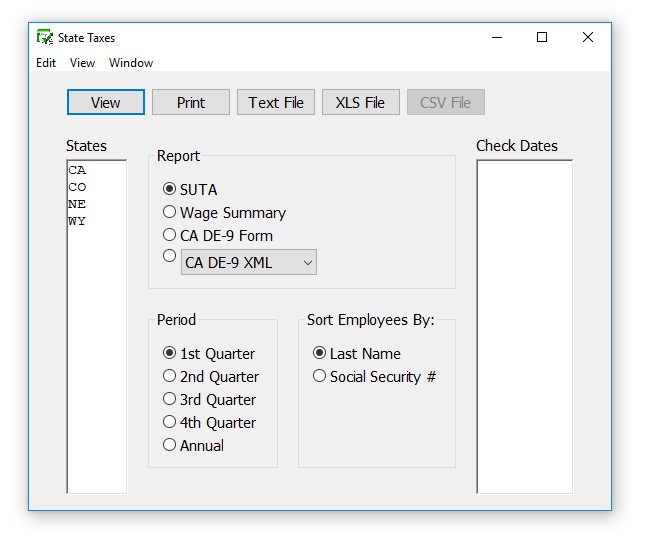

How To Create Suta Taxes Reports In Checkmark Payroll Checkmark Knowledge Base

Suta Tax Your Questions Answered Bench Accounting

What Is Sui State Unemployment Insurance Tax Ask Gusto

What Is The Suta Tax And Why Is It Going Up In 2021 Fourth

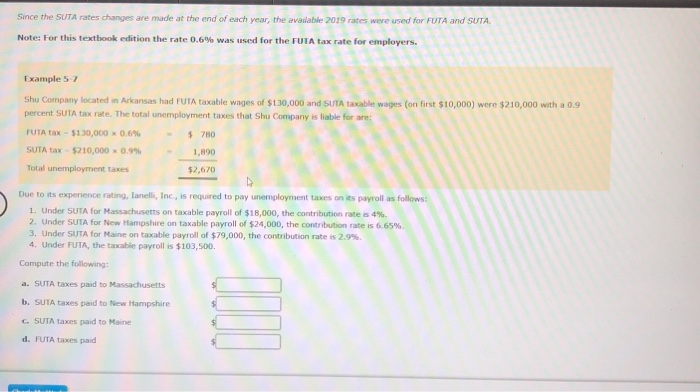

Solved Since The Suta Rates Changes Are Made At The End Of Chegg Com

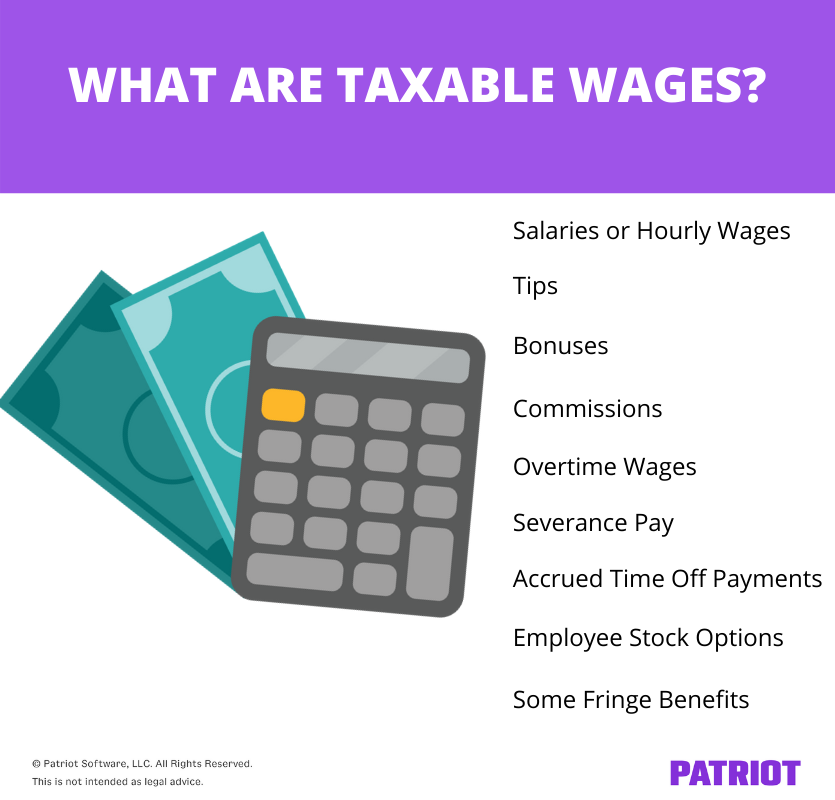

What You Need To Know About Taxable Wages 3 Things

What Is A Wage Base Taxes With Wage Bases More

How Does Your State Rank On Unemployment Insurance Taxes

How To Calculate Unemployment Tax Futa Dummies

Unemployment Taxes Federal Unemployment Tax Act Futa Ppt Download